There is a growing consensus that Bitcoin has become a valuable and scarce asset that can compete with gold, making it a promising investment for the future. The potential of cryptocurrency is no longer in doubt. Blockchain technology has also seen significant progress with the emergence of non-fungible tokens (NFTs) and decentralised finance (DeFi), representing the latest examples of the technology’s untapped prospect.

At the same time, the emergence of a new generation of cryptocurrencies, including stablecoins and central bank digital currencies, suggests that multiple regulatory, technological, and corporate adoption drivers are creating the right catalysts for accelerated crypto payments distribution and acceptance among B2B and B2C sectors, giving them the opportunity to support new commerce experiences and reach more customers locally and globally.

This article will explain how Bitcoin is driving progress in the world of payment solutions and what uses it has. You will also learn about the reasons to accept Bitcoin as payment and how to start accepting them.

Key Takeaways

- Bitcoin is the engine of progress in the development of new and improved existing crypto-processing solutions.

- Among all the advantages of using Bitcoin as a means of payment, the most significant is worldwide access.

- Bitcoin, as well as other cryptocurrencies, have found the widest use in e-commerce and retail

Bitcoin As A Driver Of The Crypto Payment Transactions Growing Popularity

Bitcoin’s role and significance have continuously evolved, transitioning from a digital equivalent of gold to a viable payment method with potential applications in various sectors. Currently, it is anticipated that Bitcoin will further establish itself as a reliable store of value, attracting a larger share of the global gold investment market.

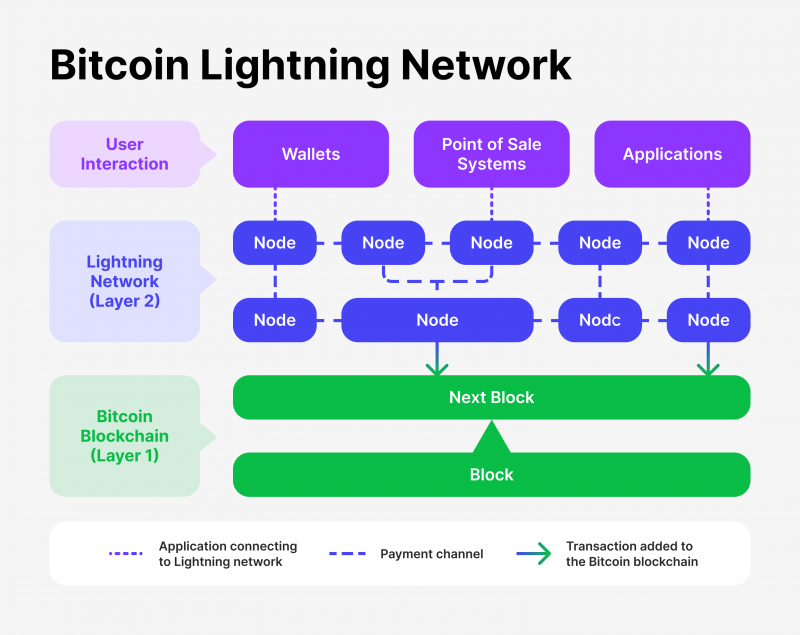

Looking ahead, if scaling solutions like the Lightning Network gain widespread adoption, Bitcoin’s utility as a means of payment could expand to encompass even larger markets. Additionally, its status as the pioneering and most trusted cryptocurrency positions it as a formidable competitor to other smart contract platforms, potentially unlocking opportunities in numerous new markets.

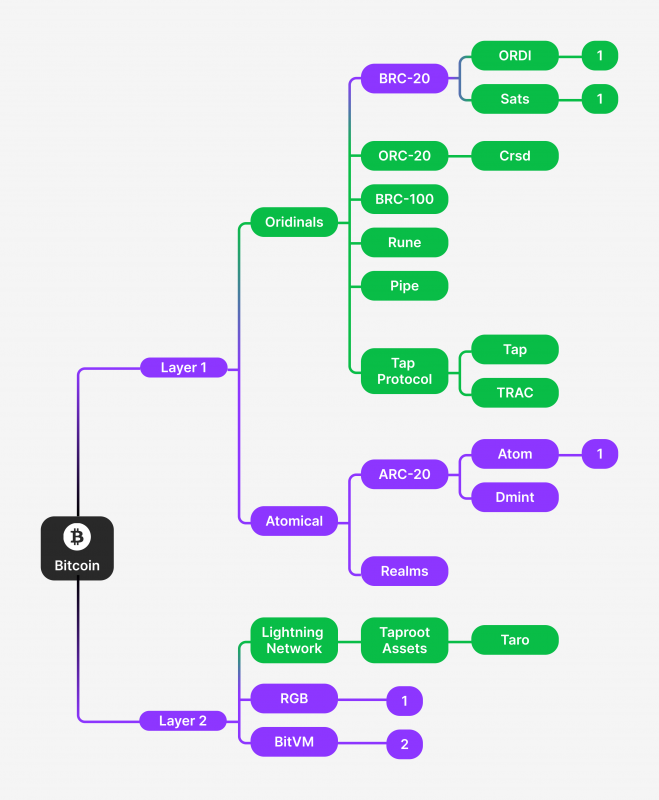

Estimating Bitcoin’s addressable market is a complex task, as it competes not only with other cryptocurrencies but also with unforeseen future innovations in its quest to capture market share from traditional assets like gold and fiat currencies. Furthermore, developers’ potential applications of the Bitcoin network still need to be determined, as demonstrated by their experience with Ordinals. Therefore, predicting the future trajectory of Bitcoin’s market penetration and impact is challenging, given the dynamic nature of the cryptocurrency landscape.

Today, Lightning Network is the most promising solution within the Bitcoin project aimed at enabling instant transactions both inside and outside the network.

Real-World Applications of Bitcoin Crypto Payments

Today, the range of areas that use Bitcoin to pay for goods and services is quite broad. It includes a wide variety of industries and companies that are improving their business processes and, in particular, payment solutions using blockchain technology. Among the main areas where companies accept Bitcoin as a payment option are:

Online Retail Sector

An increasing number of e-commerce platforms currently provide Bitcoin as a viable payment option, which proves to be particularly advantageous for businesses catering to a worldwide clientele. By accepting Bitcoin payments, companies can bypass the hassle of currency conversions and facilitate faster and more cost-effective cross-border transactions. This means that customers can now conveniently purchase a wide range of items, including tech gadgets, clothing, and digital art, using Bitcoin as their preferred payment method.

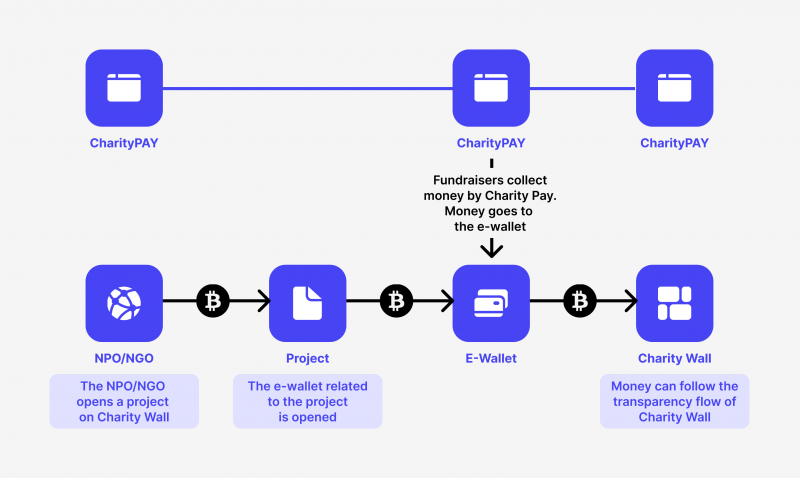

Charity and Donation

Charitable organisations are continuing accepting Bitcoin donations. By accepting such donations, they are able to receive funds from any part of the world without any delay and with minimal transaction fees, ensuring that the maximum amount possible is directed towards the intended cause.

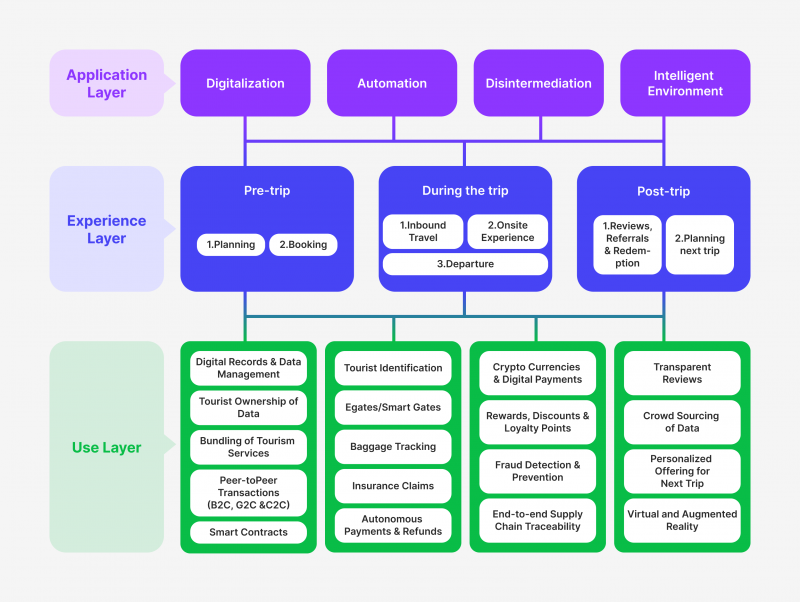

Travel and Hospitality Services

Travel agencies, airlines, and hotels across the globe are increasingly adopting Bitcoin as a payment method to facilitate seamless transactions for their international customers. With the ability to use Bitcoin for flight bookings, hotel reservations, and car rentals, travellers can easily cover all their travel needs without exchanging currencies. This simplifies the travel process and provides a secure and convenient payment option for those who prefer to use cryptocurrency.

Real Estate Sector

Bitcoin is gaining more traction in real estate deals, with certain agencies now open to accepting Bitcoin as payment for property acquisitions. This move not only speeds up the transaction process but also makes it more efficient. In particular, when it comes to international property transactions, Bitcoin has the potential to significantly cut down on transfer times and associated fees.

Freelance Services

In recent years, an increasing number of freelancers from diverse fields, such as content creation, graphic design, programming, and consulting, have started accepting Bitcoin as a mode of payment. This emerging trend is gaining popularity as it offers a fast and cost-effective way for freelancers to receive payments thought Bitcoin, particularly when working with international clients. By embracing Bitcoin payments, freelancers can enhance their financial flexibility and streamline their crypto settlement processes.

Legal Services

It’s worth noting that legal professionals worldwide are increasingly adopting Bitcoin as a method of payment for their services. This has several advantages, including making instant transactions regardless of the amount involved. International clients, in particular, can make payments without worrying about exchange rates or bank fees. Additionally, Bitcoin transactions offer extra privacy, which can be a significant factor for some clients seeking legal services.

Major Reasons To Accept Bitcoin Payments

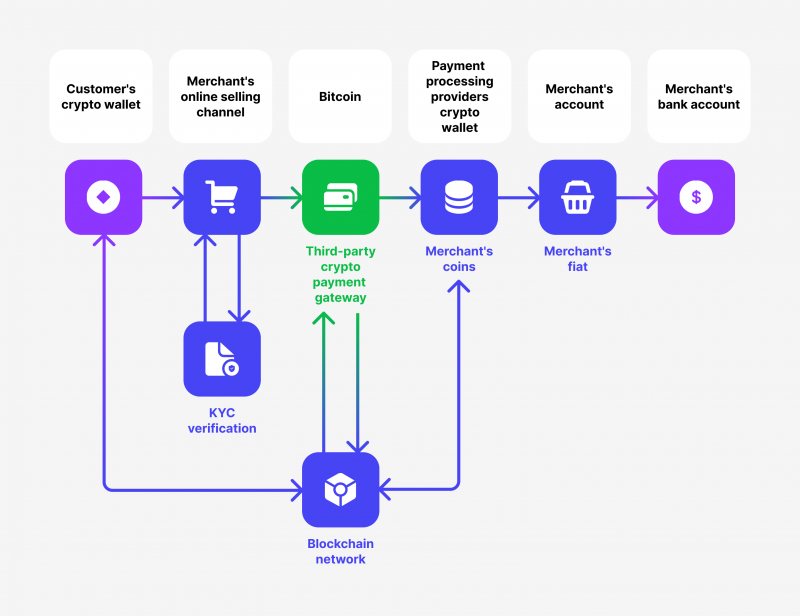

Companies that take Bitcoin for payment benefit from the exceptional advantages of blockchain innovation, which is expressed in a completely new approach to taking crypto payments in which different systems are involved, from a crypto payment service provider to a cryptocurrency payment processor. On the other hand, their clients also have certain benefits, which are made possible for the following reasons:

1. Enhanced Security and Reduced Fraud Risk

Bitcoin offers a significant advantage through its innovative blockchain technology, which guarantees the integrity of transactions using sophisticated cryptographic methods. In contrast to conventional payment systems that are vulnerable to fraud and chargebacks, Bitcoin transactions are secure and cannot be altered. This heightened level of security minimises the risk of fraud for businesses and fosters trust and confidence among customers.

2. Global Access

With its borderless nature, Bitcoin emerges as a currency that grants businesses a BTC gateway to the worldwide marketplace. By embracing Bitcoin as a form of payment, it becomes possible to effortlessly cater to customers from any part of the world without the inconvenience of dealing with currency conversion or cross-border transaction fees. This is not only expands the customer base but also positions a brand as forward-thinking and inclusive on a global scale.

3. Transactions Efficiency and Speed

The speed of the Bitcoin payment system benefits businesses domestically and internationally. With traditional bank transfers, international transactions can be particularly slow and cumbersome. In contrast, Bitcoin payments offer a swift solution, allowing businesses to conduct cross-border transactions efficiently and effectively. By embracing Bitcoin as a payment method, businesses can streamline their financial operations and stay ahead in today’s fast-paced global economy.

4. Payment Flexibility

With the rise of digital currencies, an increasing number of customers are looking for businesses that accept them as payment. By incorporating Bitcoin as one of the payment options, it’s possible to keep pace with the latest technological developments and cater to the growing customer desire for versatility and originality in payment methods. This move can set you apart from other businesses and position you as a forward-thinking, customer-centric enterprise that adapts to changing market trends and preferences.

5. Superior Privacy

Bitcoin merchant services offer shoppers a unique advantage during checkout by eliminating the need for additional personal information. Unlike traditional payment methods such as credit and debit cards, cryptocurrency transactions do not require customers to divulge sensitive information.

This assures that your customers’ financial data remains secure and private and is not at risk of being accessed by third parties such as banks, payment services, advertisers, and credit-rating agencies. By using cryptocurrency, shoppers can enjoy a more secure and private online shopping experience.

6. Lower Transaction Fees

The disparity in cost between traditional payment methods and Bitcoin transactions underscores the potential for significant savings for businesses, particularly SMEs.

By leveraging the lower fees associated with Bitcoin transactions, companies can allocate more resources towards growth and development rather than being burdened by high transaction costs. As a result, the cost-effectiveness of Bitcoin transactions offers a competitive edge to businesses seeking to optimise their financial operations.

The Procedure for Accepting Bitcoin Payments in 2024

To date, the process of implementing Bitcoin payment processing solutions to accept Bitcoin as payment within a single company or startup has not changed significantly compared to previous years and is a series of sequential steps, including the gradual implementation of the necessary infrastructure designed to work with digital payment transactions. Such steps include:

1. Be Aware of Cryptocurrency Laws

Before delving into cryptocurrency payments, it is crucial to thoroughly prepare and familiarise oneself with all legal considerations, such as ongoing legislative initiatives related to cryptocurrency regulation and examining service policies and other regulatory frameworks governing crypto transactions.

This also extends to the selection of a Bitcoin wallet for businesses for storing various cryptocurrencies, as each company may have distinct requirements and terms for utilising their products and services. Understanding and adhering to these guidelines is essential in initiating cryptocurrency payments effectively.

2. Get a Bitcoin Wallet

Commence your Bitcoin journey by procuring a Bitcoin wallet, an electronic repository designed to ensure the secure storage, transmission, and reception of Bitcoins. Diverse wallet alternatives are at your disposal, ranging from software wallets to hardware wallets and online wallets. Select a crypto wallet integration that best caters to your individual preferences, taking into account factors such as security, convenience, and accessibility.

3. Choose a Payment Processor

If you are considering incorporating Bitcoin payments into your business operations, it is worth exploring the utilisation of a payment processor or digital currency payment gateway that accept Bitcoin and supports this cryptocurrency. These specialised platforms are crucial in streamlining Bitcoin transactions and offer integration options tailored for businesses. Some reputable crypto payment processors include B2BinPay, CoinGate, and Coinbase Commerce. To ensure a seamless fit, conducting comprehensive research and evaluating different providers is essential to find the one that aligns perfectly with your unique needs and preferences.

4. Integrate Bitcoin Payment Gateway

Enhancing your existing payment infrastructure to include the Bitcoin payment option requires the implementation of the necessary API or plugins provided by your chosen payment processor. The integration process may vary depending on the nature of your website or point-of-sale (POS) system. To obtain specific instructions on how to integrate, it is recommended to consult the documentation and support resources offered by the payment processor.

5. Display Bitcoin as a Payment Option

Ensure that your customers are aware of your willingness to accept Bitcoin by prominently displaying the Bitcoin logo or a “Bitcoin Accepted Here” sign on your website, online store, or physical point-of-sale. By doing so, you can effectively educate your customers about the availability of Bitcoin as a payment option and encourage them to utilise this method for their transactions.

6. Set Prices and Convert to Fiat (Optional)

Consider whether you prefer to set the prices of your products or services directly in Bitcoin or opt to convert Bitcoin prices into fiat currency during the purchase process. In choosing the latter, you have the option to utilise the services of a payment processor that provides automatic conversion to your desired currency. This approach can assist in minimising the potential risks arising from the volatility of Bitcoin’s price fluctuations.

7. Monitor and Manage Transactions

To effectively manage your Bitcoin holdings, it is important to regularly monitor your Bitcoin wallet and payment processor account for incoming transactions. Additionally, it is crucial to prioritise the implementation of robust security measures to protect your wallet and private keys from unauthorised access. By staying vigilant and taking necessary precautions, you can ensure the safety and security of your Bitcoin assets.

8. Stay Informed and Comply with Regulations

If you are considering accepting Bitcoin payments, staying informed about your jurisdiction’s latest regulations and tax requirements is essential. You should familiarise yourself with any legal obligations, reporting requirements, or tax implications of Bitcoin transactions. For instance, some countries classify Bitcoin as a commodity, while others consider it a currency.

As a result, the regulatory and tax framework may differ depending on your location. Additionally, you should know of any potential risks associated with Bitcoin transactions, such as market volatility and security concerns. It is always recommended to consult with a financial or legal expert to ensure you follow the applicable regulations and tax laws in your area.

Conclusion

In today’s business landscape, integrating cryptocurrency processing has become pivotal for corporations seeking growth and market penetration. By embracing the technology of crypto payments, companies can make significant strides in streamlining mutual settlements and attracting a more extensive customer base.

This novel payment approach provides customers with a seamless and secure method to accept Bitcoin as payment, thus purchase and access services. It eliminates the burden of exorbitant fees and protracted transaction processing times commonly associated with conventional payment methods.

FAQ

How many businesses accept crypto?

At present, Bitcoin is accepted by more than 15,000 businesses globally, including approximately 2,300 companies in the United States alone. Most of these crypto-friendly establishments are small businesses.

What are the risks of accepting cryptocurrency?

Accepting cryptocurrency payments comes with certain risks, such as the potential price fluctuations, as well as the difficulty of maneuvering through an ever-changing and unpredictable regulatory landscape.

Why is it difficult for most businesses to accept Bitcoin as a form of payment?

Integrating Bitcoin as a payment method is a simple task for businesses. Still, the fluctuating price and the ever-changing global regulations may deter some from embracing it due to the resulting uncertainty.